Accurate & Compliant Payroll Services

Streamline your Oklahoma Payroll Process

Enhance your Oklahoma payroll operations with our comprehensive payroll and HR solution, backed by exceptional client support customized for the unique business landscape throughout the Sooner State, from Oklahoma City to Tulsa. We ensure compliance with Oklahoma-specific regulations, precise execution, and swift payments, simplifying payroll management in Oklahoma.

Experience Painless Payroll Setup

Smooth & Reliable Transition for Oklahoma Businesses

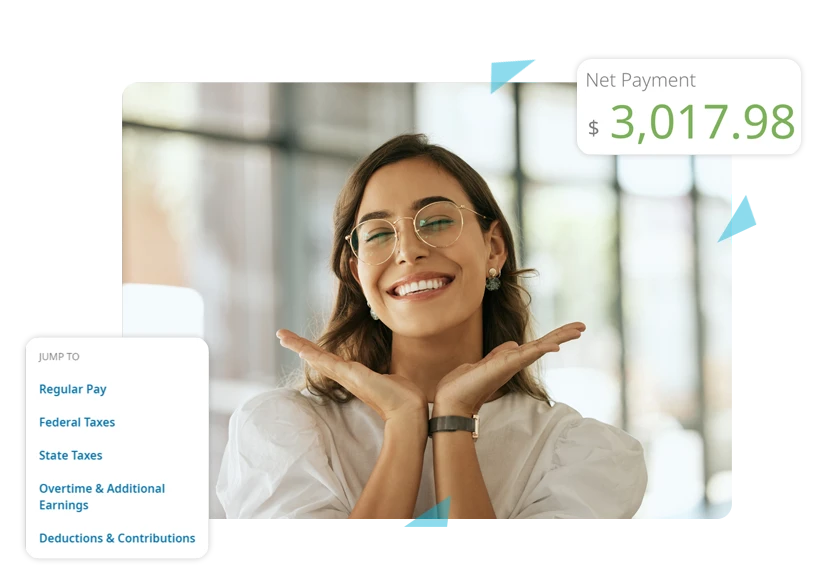

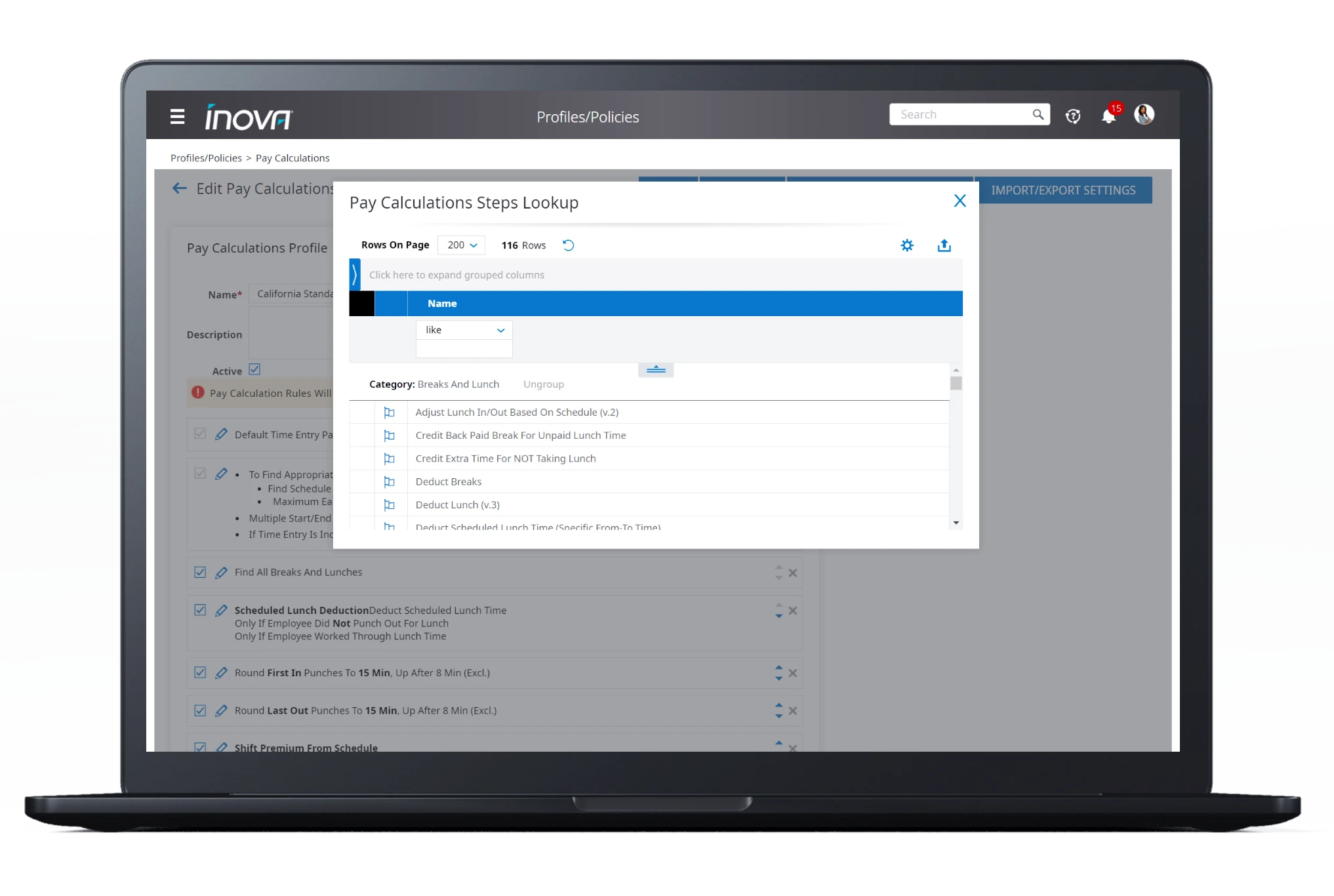

Increase Accuracy, Save Time, and Minimize Risk

Efficient Payroll Processing for Oklahoma’s Dynamic Market

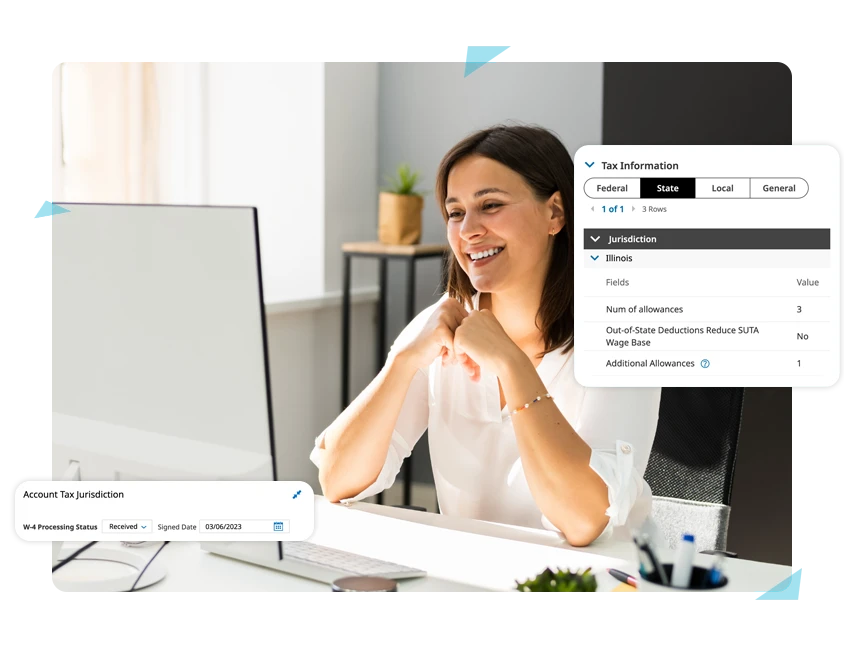

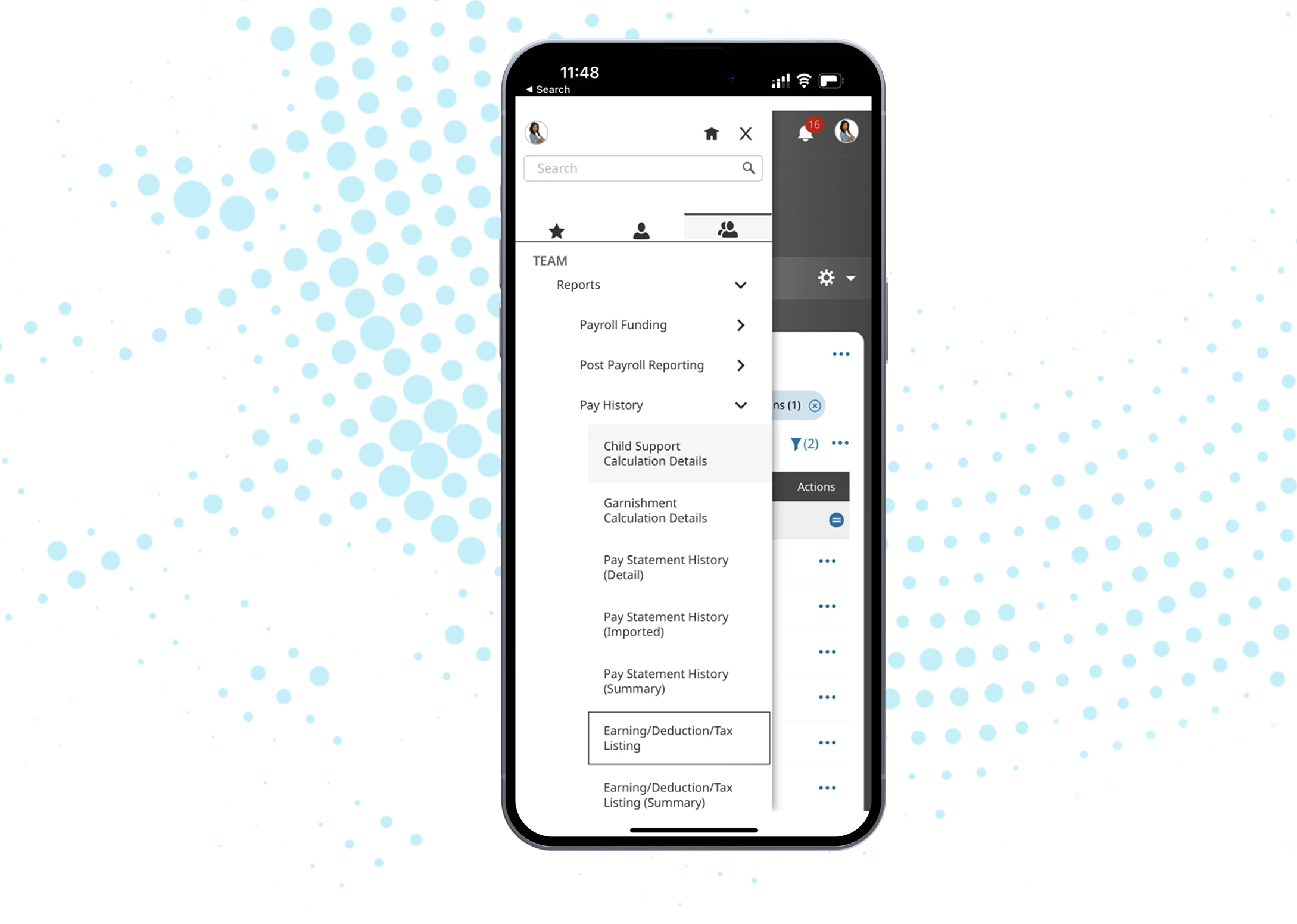

Stay on Top of the Latest Regulations and Requirements

Built-In for Oklahoma Businesses

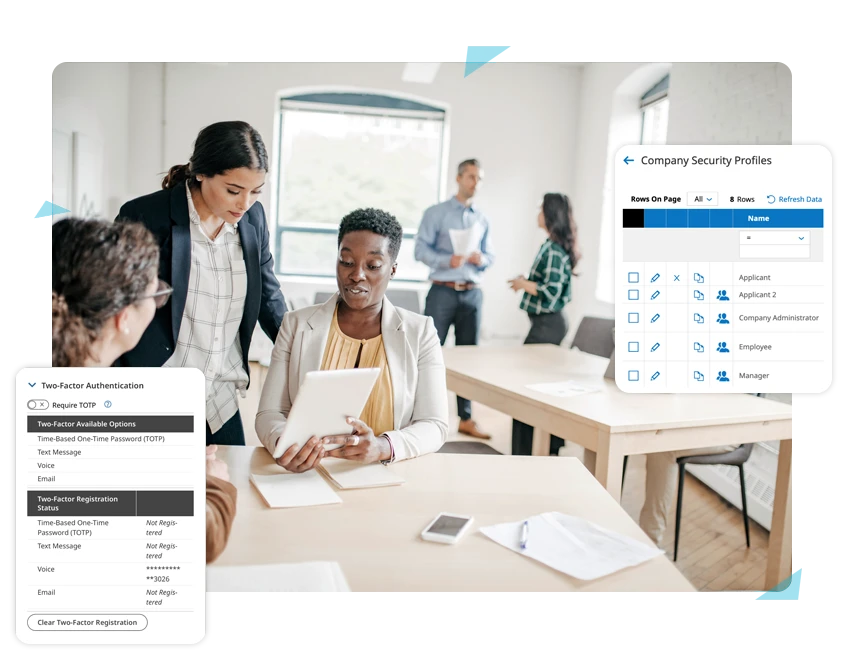

Work with People Who Know What They’re Doing

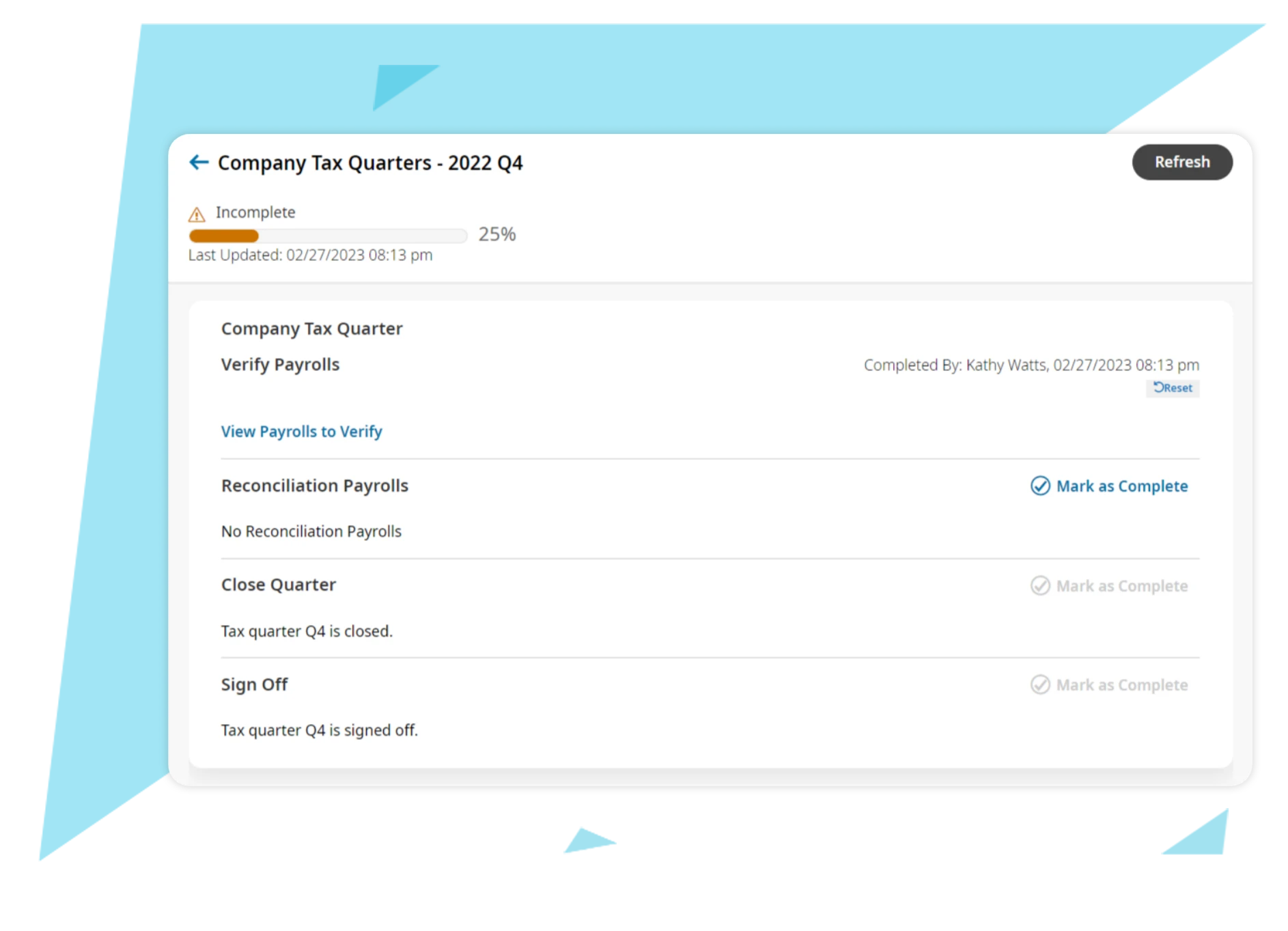

Trustworthy Tax Filing for Oklahoma Businesses