On May 20, 2025, the U.S. Senate unanimously passed the “No Tax on Tips Act”.—a landmark bipartisan bill designed to provide income tax relief for tipped workers. Just days later, on May 22, the House passed a broader tax package, dubbed the “One Big, Beautiful Bill Act,” that includes a temporary version of the same benefit. These back-to-back developments have far-reaching implications for both employees and employers in service-driven industries.

Here’s what’s in the proposed legislation, what it could mean for your business, and how HR and payroll teams can prepare.

What’s the No Tax on Tips Act?

The No Tax on Tips Act, first proposed by Senator Ted Cruz in June 2024 and reintroduced in 2025, aims to exempt up to $25,000 in tips from federal income taxes for qualifying workers.

Key provisions include:

- Annual cap: Employees can deduct up to $25,000 in cash tips per year.

- Eligibility: Applies to workers earning under $160,000 (indexed to inflation) in traditionally tipped roles, including:

- Restaurant servers and bartenders

- Hotel and hospitality workers

- Rideshare and taxi drivers

- Delivery drivers

- Hairstylists and barbers

- Estheticians and nail technicians

- Other service industry professionals who regularly receive tips

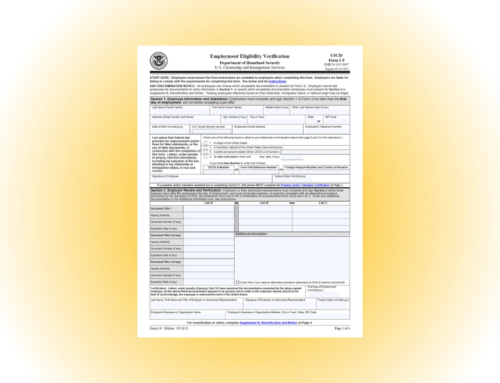

- Reporting requirement: To qualify, tips must be reported to the employer and subject to payroll tax withholding.

- Expanded employer credit: The bill also broadens eligibility for the existing FICA tip credit to include spa and beauty services.

This act passed with unanimous support in the Senate, indicating broad bipartisan agreement on the need to ease the tax burden on tipped workers.

The House’s Response: A Broader Tax Package

The House version of tip tax relief came as part of a much larger piece of legislation: the “One Big, Beautiful Bill Act.” This sweeping package includes tax extensions, healthcare-related work requirements, and social program reforms—and it contains a similar tip tax exemption with a few key differences:

- Temporary exemption: Rather than a permanent change, the House bill makes tips income tax-free for four years.

- Eligibility caveats: Only taxpayers with a valid Social Security number—and, if married, a spouse who also has one—can claim the deduction.

- Overtime relief included: The bill also proposes eliminating federal income tax on overtime pay, further aiming to support working-class Americans.

The House version reflects a more partisan effort, passing along party lines, and will now require reconciliation with the Senate.

What Does This Mean for Employers?

If either version of tip tax relief becomes law, HR, payroll, and finance teams will need to adjust systems, policies, and employee communications. Here are some ways it could affect your organization:

1. Payroll Adjustments and Tax Reporting

The Senate bill still requires tips to be reported and subject to payroll taxes (i.e., Social Security and Medicare). However, the income tax exemption means employers may need to:

- Update payroll systems to track exempt tip income for year-end tax reporting.

- Provide education and training for managers and staff on accurate tip reporting.

- Adjust W-2s to reflect taxable vs. non-taxable income where appropriate.

Employers using payroll software should ensure their vendors are monitoring the legislation closely and planning for necessary updates.

2. Communications and Education

Many tipped workers may not fully understand how tax withholding works—and confusion could increase with a partial exemption.

HR departments will need to:

- Provide clear guidance on what types of tips qualify (i.e., cash tips vs. credit card tips).

- Educate employees on continued reporting requirements, even though income taxes may no longer apply.

- Reiterate that FICA (Social Security and Medicare) taxes still apply unless future legislation changes that.

Employers may also want to work with payroll vendors or tax advisors to develop educational handouts or FAQs for staff.

3. Impacts on FICA Tip Credit for Employers

Under current law, employers may claim a tax credit for the employer portion of FICA taxes paid on tips in excess of the federal minimum wage. The Senate’s No Tax on Tips Act expands this credit to include industries like salons and spas, not just restaurants.

If passed, this could create new savings opportunities for businesses that have never been eligible before.

Employers should:

- Review eligibility criteria with their tax advisors.

- Evaluate whether they can retroactively claim credits based on tip reporting if the law allows.

- Prepare to document eligible tips and payroll taxes paid for future filings.

4. Recruitment and Retention Impacts

The proposed tax break may help employers stand out when hiring in a competitive labor market. If up to $25,000 in tip income becomes tax-free, tipped jobs could suddenly look more attractive to job seekers.

Industries like hospitality, food service, and salons—where recruitment and turnover are often pain points—may be better positioned to:

- Market the potential increase in take-home pay.

- Emphasize the stability of tip income without tax erosion.

- Use the benefit as a differentiator in job postings or during onboarding.

5. Operational and Compliance Considerations

As with any policy shift, the details matter. Employers should prepare for a few potential operational and compliance curveballs, including:

- Increased IRS scrutiny: If tip reporting rises significantly (due to the tax benefit), the IRS may increase audits in the service industry.

- Fraud concerns: Some employees may be tempted to inflate reported tip income to reach the deduction threshold.

- State tax conflicts: States may or may not follow suit in exempting tips from income tax. HR teams must track individual state responses.

What’s Next?

The Senate and House must now reconcile their differences. Possible outcomes include:

- The Senate passes the House bill as-is.

- Lawmakers create a unified version of the bill in conference committee.

- The bills stall due to political gridlock.

Regardless of the path, employers should begin evaluating their readiness and stay informed on final legislation. If signed into law, implementation timelines may vary—but proactive planning can reduce compliance risks and ensure a smooth transition.

What HR and Payroll Leaders Can Do to Prepare

To stay ahead of the proposed changes, HR and payroll leaders should begin laying the groundwork now. Here are five proactive steps to consider.

- Monitor the legislation through trusted sources like the IRS, SHRM, or your payroll provider.

- Audit your current tip reporting practices for accuracy and consistency.

- Engage your payroll vendor to understand upcoming system changes.

- Prepare employee communication plans to explain any changes in tip taxation.

- Consult your tax advisor to identify potential employer credits or savings

Whether passed as a standalone bill or bundled in a broader tax package, the proposed tip tax relief is a potentially game-changing move for service-based businesses and their employees. With the potential to increase take-home pay for workers and create tax advantages for employers, the No Tax on Tips Act could reshape the landscape of the service economy.

HR and payroll professionals should act now to get ahead of these changes and ensure their organizations are ready to take full advantage of the opportunities—and responsibilities—this legislation may bring.