On November 15, 2024, the U.S. District Court for the Eastern District of Texas invalidated the Department of Labor’s (DOL) white-collar overtime exemption rule under the Fair Labor Standards Act (FLSA). The court ruled that the regulation, which raised salary thresholds and included automatic updates, exceeded the DOL’s statutory authority.

Summary of Key Points

- Rule Invalidated Nationwide: The decision vacates the DOL’s rule entirely, reverting salary thresholds to 2019 levels.

- Conflict with FLSA: The court found the rule created a “salary-only” test, overshadowing the duties test required by the FLSA.

- Automatic Escalation Struck Down: The automatic three-year updates to salary thresholds violated federal regulatory procedures.

- DOL Appeal Possible: The DOL may appeal the ruling, but the outcome could be influenced by the incoming administration.

Background on the Overtime Exemption

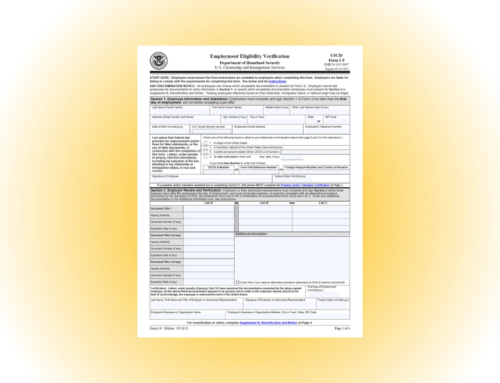

Under the FLSA, certain executive, administrative, and professional (EAP) employees are exempt from overtime pay requirements if they meet three criteria:

- They are paid on a salary basis.

- Their primary job duties qualify as exempt EAP duties.

- Their earnings meet or exceed the minimum salary threshold.

The 2024 Rule

In April 2024, the DOL introduced updates to the salary thresholds for the first time since 2019. The rule included:

- A July 1, 2024 increase to $844 per week ($43,888 annually).

- A January 1, 2025 increase to $1,128 per week ($58,656 annually).

- Automatic salary threshold updates every three years.

- An increase in the Highly Compensated Employee (HCE) threshold from $107,432 to $132,964 in July 2024, with a further increase to $151,164 in January 2025.

The court’s ruling has invalidated all these changes.

Court’s Decision

The court identified three key reasons for vacating the rule:

- Conflict with FLSA: The salary increases created a “salary-only” test, contrary to the FLSA’s emphasis on job duties for determining exempt status.

- Regulatory Violation: The automatic updates every three years violated the Administrative Procedure Act by bypassing required regulatory processes.

- Nationwide Impact: Given the scope of the rule, the court determined that invalidating it nationwide was necessary to protect employers and employees.

Impacts and Next Steps

The ruling has significant implications for employers:

- Reversion to 2019 Thresholds:

- EAP exemption: $684 per week ($35,568 annually).

- HCE exemption: $107,432 per year.

- July and January Increases Nullified: The planned January 1, 2025, threshold increase and the July 1, 2024, increase are no longer valid.

- Consult Legal Counsel: Employers who adjusted salaries or exemption statuses due to the July 2024 rule should seek legal advice before making further changes.

- State-Level Thresholds: Employers must remain aware of state-specific salary thresholds, which may exceed federal levels, such as in California and Washington.

The DOL may appeal the decision to the Fifth Circuit Court of Appeals. Employers are encouraged to monitor developments closely as the regulatory landscape evolves.