In a move that could reshape how employers determine overtime eligibility, the U.S. Supreme Court recently heard oral arguments on a pivotal case regarding overtime exemption standards under the Fair Labor Standards Act (FLSA). This review has the potential to unify or redefine the evidentiary standards used to classify employees as exempt from overtime pay.

For HR professionals, the stakes are high, as the outcome could directly impact wage and hour compliance strategies. Here’s what you need to know about this significant legal development.

Background on Overtime Exemptions

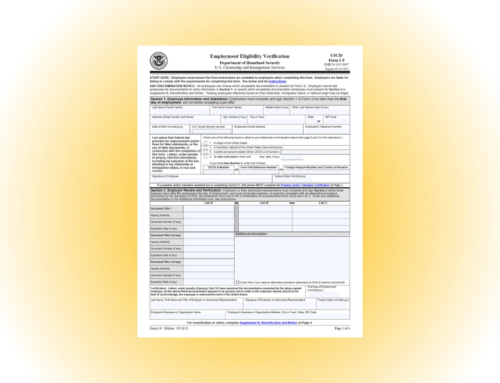

Under the FLSA, most employees are entitled to overtime pay at 1.5 times their regular hourly rate for any hours worked over 40 in a week. However, employees who qualify for an overtime exemption based on specific criteria—such as job duties, salary level, and payment method—are not eligible for overtime pay.

Employers use the “primary duties” test to classify exempt employees, but federal courts have historically applied different standards when determining whether an overtime exemption is valid. This inconsistency has created challenges for multi-state employers and increased the risk of misclassification.

Why the Supreme Court Review Matters

On November 5, 2024, the Supreme Court heard oral arguments in a case that could redefine the evidentiary burden employers must meet to claim an overtime exemption for their employees. The central question is whether job duties alone are enough to qualify employees for an exemption or whether courts should also consider the nature of the employee’s actual work and employer oversight.

A decision, expected by June 2025, could establish a unified standard across jurisdictions or raise the bar for proving overtime exemption, forcing employers to revisit their classification practices.

Potential Impacts on Employers and HR Teams

The Court’s decision on overtime exemption could have far-reaching consequences for employers and HR professionals:

- Consistency Across States

A unified standard for overtime exemption would simplify compliance for businesses operating in multiple jurisdictions. However, stricter requirements could increase the burden of proof and expose employers to greater legal risks. - Job Classification Audits

HR teams may need to reevaluate their overtime exemption classifications, ensuring that job descriptions and actual duties align with the Court’s ruling. Misclassifications could lead to back pay liabilities and penalties. - Increased Administrative Effort

Employers may face additional administrative tasks, including policy updates, employee training, and consultation with legal experts to ensure compliance with the new overtime exemption standards. - Employee Relations Challenges

If roles are reclassified from exempt to nonexempt, employees may experience changes in work hours or compensation, potentially impacting morale and engagement.

Preparing for Potential Changes to Overtime Exemption Standards

While the ruling is still pending, HR professionals can take proactive steps to prepare for possible changes in overtime exemption criteria:

- Conduct Classification Audits: Review employee classifications to ensure they meet current FLSA requirements for exemption.

- Document Classification Decisions: Maintain thorough records of job duties and other factors supporting exemption determinations.

- Stay Informed: Keep up-to-date with case developments and seek legal guidance to assess how changes to exemption standards might affect your organization.

- Communicate Transparently: Inform employees about any potential changes to their classifications and how it may impact their compensation.

What’s Next for Overtime Exemption?

The Supreme Court’s decision is expected by June 2025. Regardless of the outcome, HR professionals must remain proactive in understanding and implementing any changes to compliance requirements.

By staying ahead of the curve, HR teams can ensure their organizations are prepared for the evolving legal landscape surrounding overtime exemption while maintaining a fair and compliant workplace.