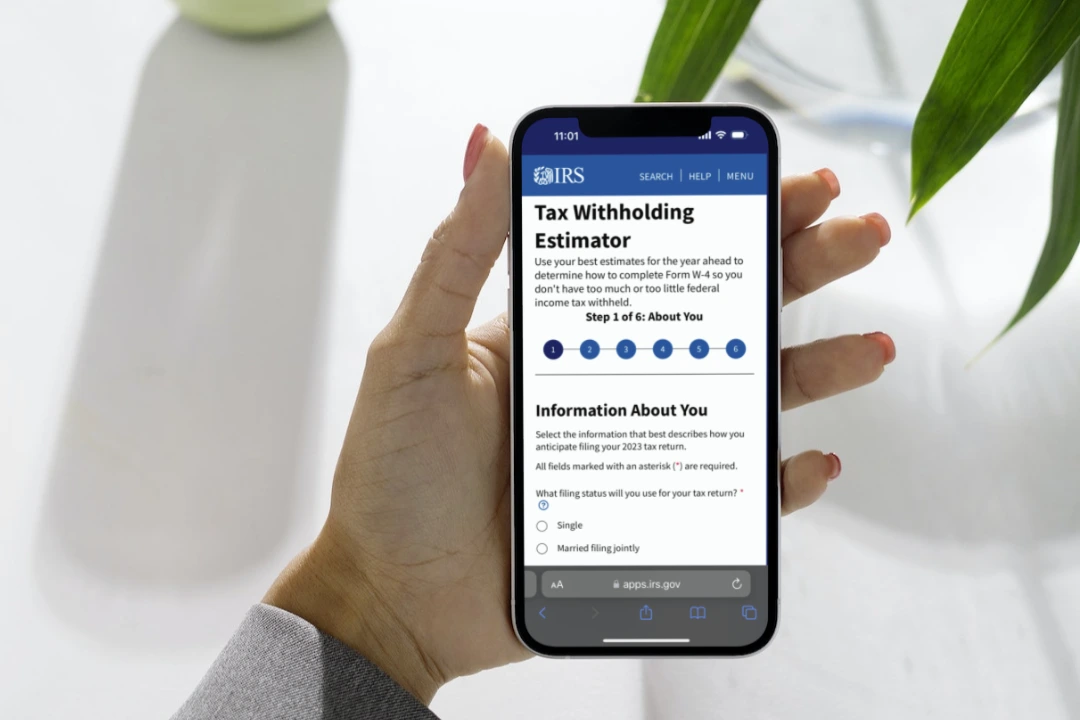

The 2023 tax filing season has ended for most in the U.S. Did you find yourself with a surprise tax bill or a smaller refund than you were expecting this filing season? If so, you may want to use the recently released free IRS Tax Withholding Estimator to help proactively prepare for 2024.

The Tax Withholding Estimator tool provides workers, retirees, and self-employed taxpayers with a step-by-step guide to effectively tailor the amount of income tax to have withheld from their wages, pension, and other income. A major life change such as marriage, divorce, home purchase, birth or adoption of a child. or a big change in income could make the tool especially useful. Even if you’ve already filed, you can take advantage of this tool to adjust how much is withheld and possibly give you a larger return or avoid a tax bill for 2023.

Benefits the Tax Withholding Estimator

Employers “withhold” a set amount of your income from your paycheck. This tool could become handy (especially if you’ve gone through one of the major life changes listed above) to determine if you need to complete a new W-4 Form to your employer. Why should you check if you need to re-submit this form? Using this tool could help you to:

- Ensure the right amount of tax is withheld and prevent an unexpected tax bill or penalty at tax time

- Determine whether to have less tax withheld from each paycheck, boost take-home pay and reduce refunds at tax time

What Records Do I Need to Use the Tool?

The Tax Withholding Estimator’s results are only as accurate as the information entered. To help prepare, the IRS recommends you pull together:

- Pay statements for yourself and spouse (if applicable)

- Any documentation or information on other sources of income

- Your most recent income tax return (2022 if possible)

Withholding or Estimated Payments?

As taxpayers earn or receive income throughout the year, income taxes must be paid. This can be done either through withholding or estimated tax payments. If the amount of income tax withheld from one’s salary or pension is not enough, or if they receive other types of income such as interest, dividends, self-employment income, alimony, capital gains, prizes, or awards, they may need to make estimated tax payments.

According to the IRS, taxpayers who received more than $600 in income from third-party settlement organizations in 2023, including popular payment apps, may receive Form 1099-Ks. Individual taxpayers can use the IRS Interactive Tax Assistant to see if they’re required to pay estimated taxes. As with all things tax-related, good recordkeeping is essential.

Who Shouldn’t Use the Tax Withholding Estimator ?

You should not use the Tax Withholding estimator if you:

- Have a pension but not a job – Use the new Form W-4P to estimate your withholding

- Have a nonresident alien status – Use Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens

- Have a complex tax situation – This includes individuals with alternative minimum tax, long-term gains, or qualified dividends. See the instructions found in Publication 505, Tax Withholding and Estimated Tax.

For More Information:

- Tax Withholding Estimator FAQs

- Paycheck Checkup