Accurate & Compliant Payroll Services

Streamline your Missouri Payroll Process

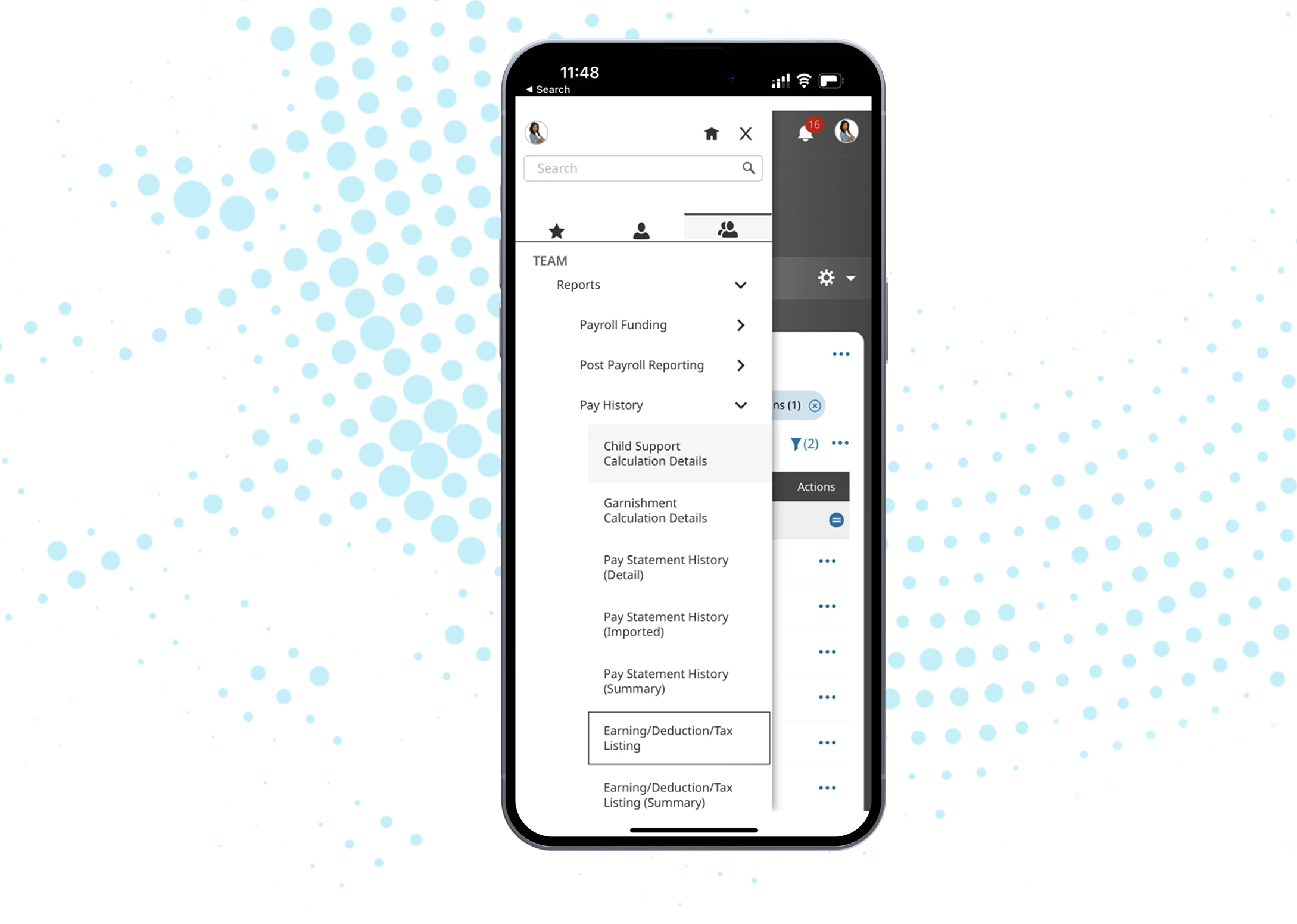

Streamline your Missouri payroll tasks with our unified payroll and HR solution, bolstered by exceptional client support adapted for the varied business landscape throughout the Show-Me State, from Kansas City to St. Louis. We ensure compliance with Missouri-specific regulations, precise processing, and prompt payments, simplifying payroll management in Missouri.

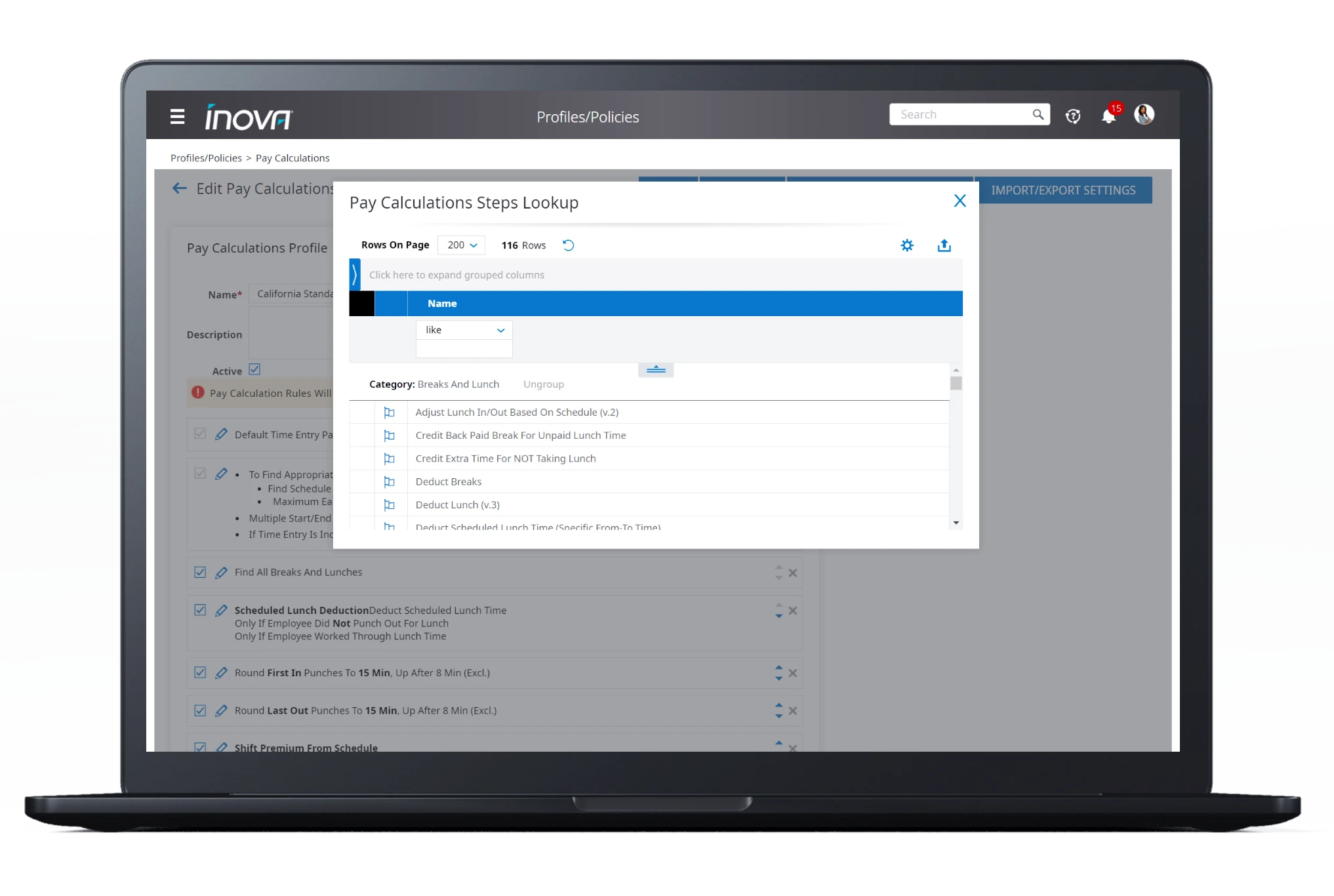

Experience Painless Payroll Setup

Smooth & Reliable Transition for Missouri Businesses

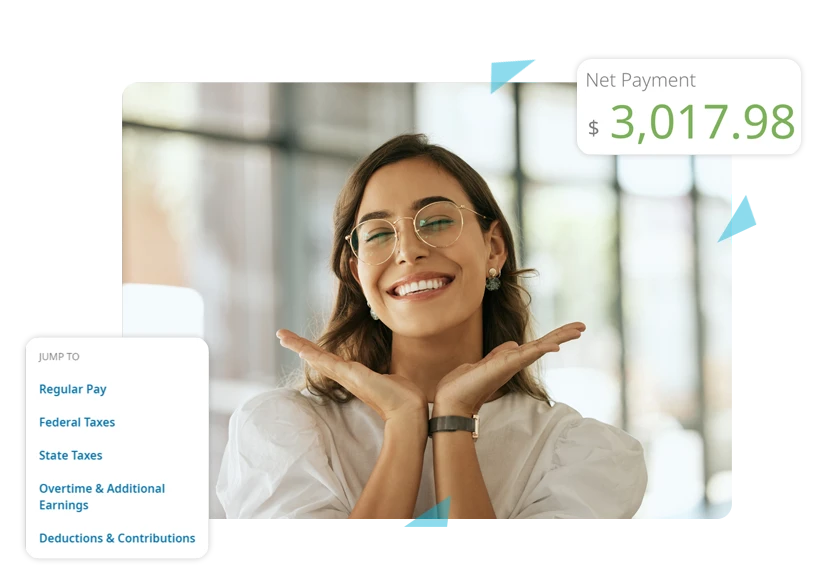

Increase Accuracy, Save Time, and Minimize Risk

Efficient Payroll Processing for Missouri’s Dynamic Market

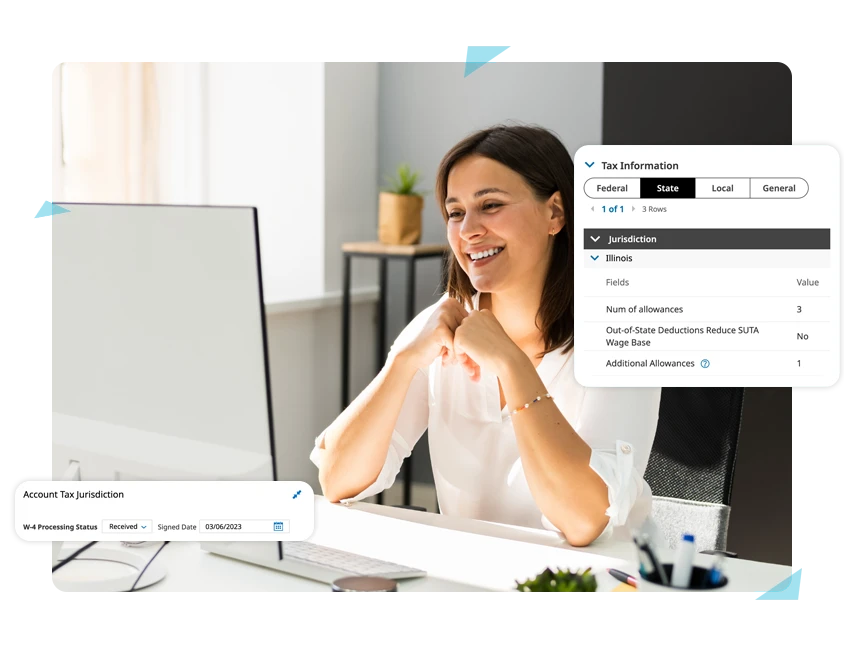

Stay on Top of the Latest Regulations and Requirements

Built-In for Missouri Businesses

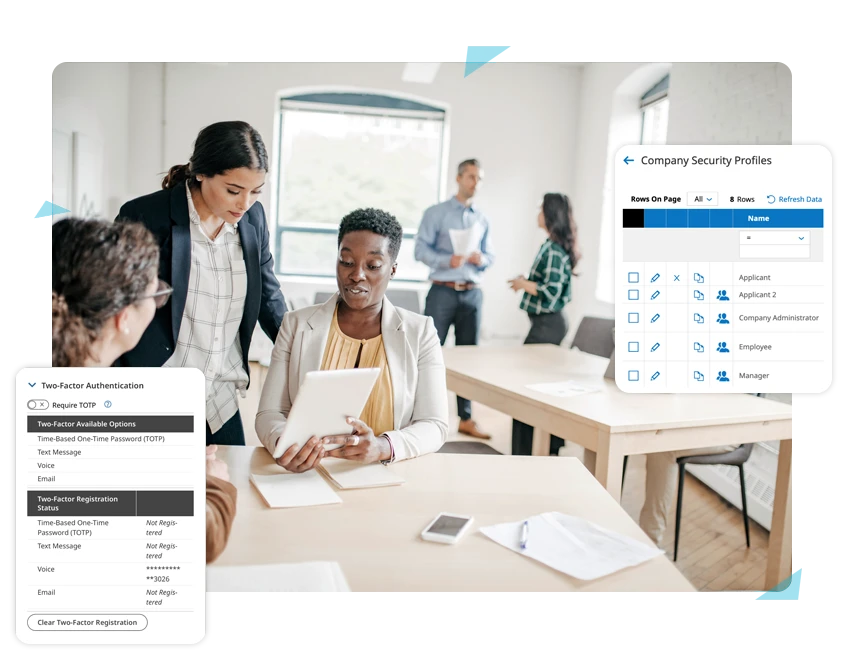

Work with People Who Know What They’re Doing

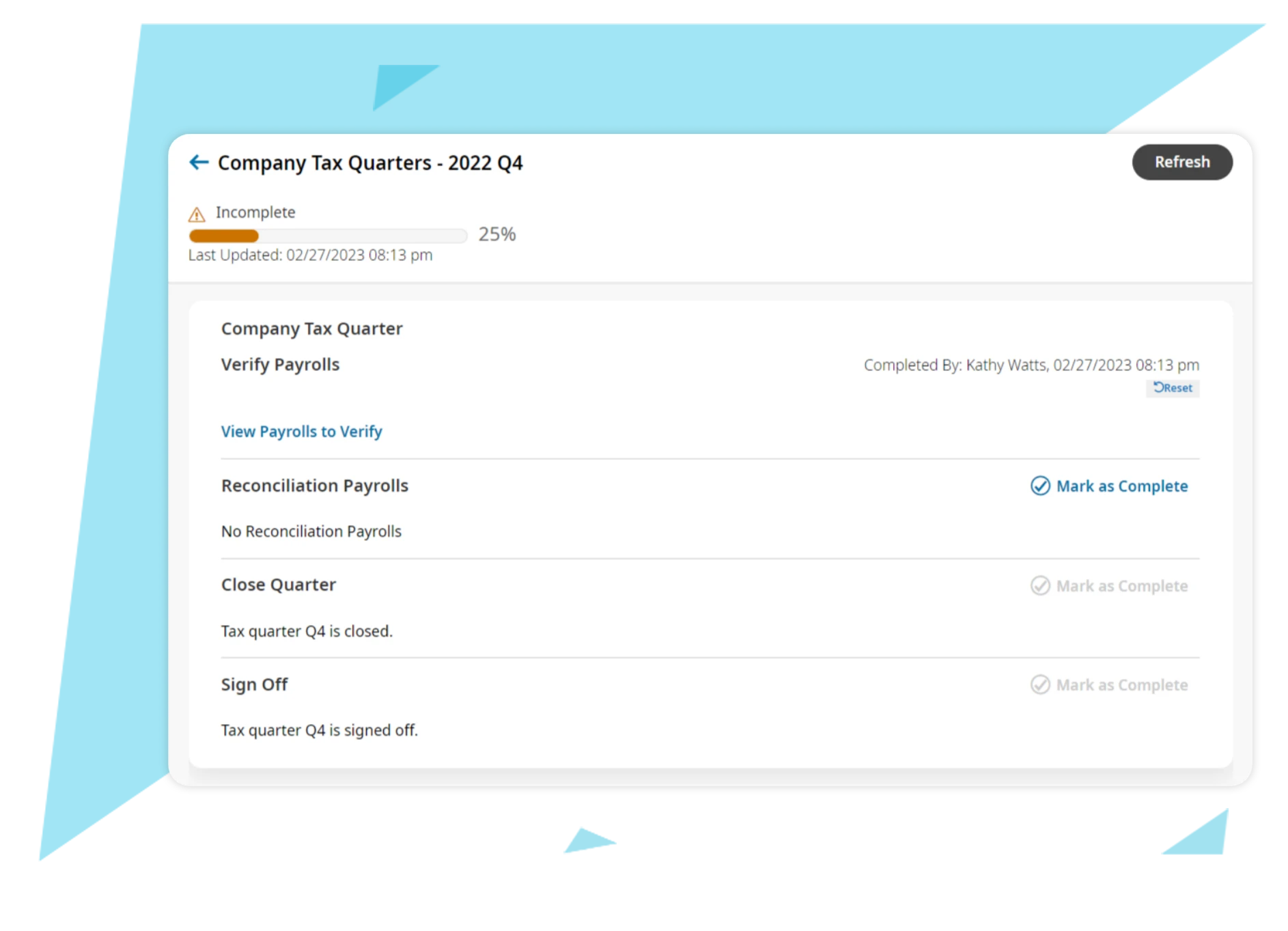

Trustworthy Tax Filing for Missouri Businesses