Accurate & Compliant Payroll Services

Streamline your Nevada Payroll Process

Streamline your Nevada payroll operations with our all-encompassing payroll and HR solution, bolstered by unparalleled client support designed for the unique business environment throughout the Silver State, from Las Vegas to Reno. We ensure adherence to Nevada-specific regulations, meticulous processing, and prompt payments, simplifying payroll management in Nevada.

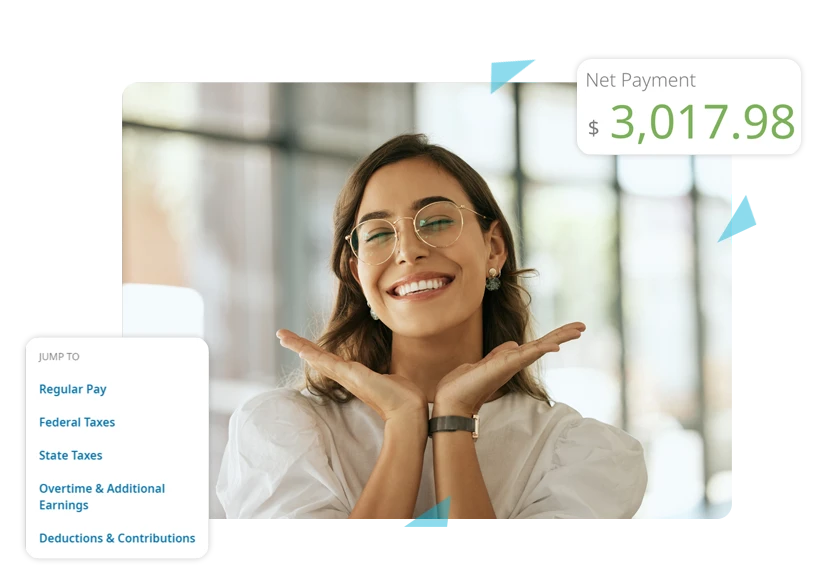

Experience Painless Payroll Setup

Smooth & Reliable Transition for Nevada Businesses

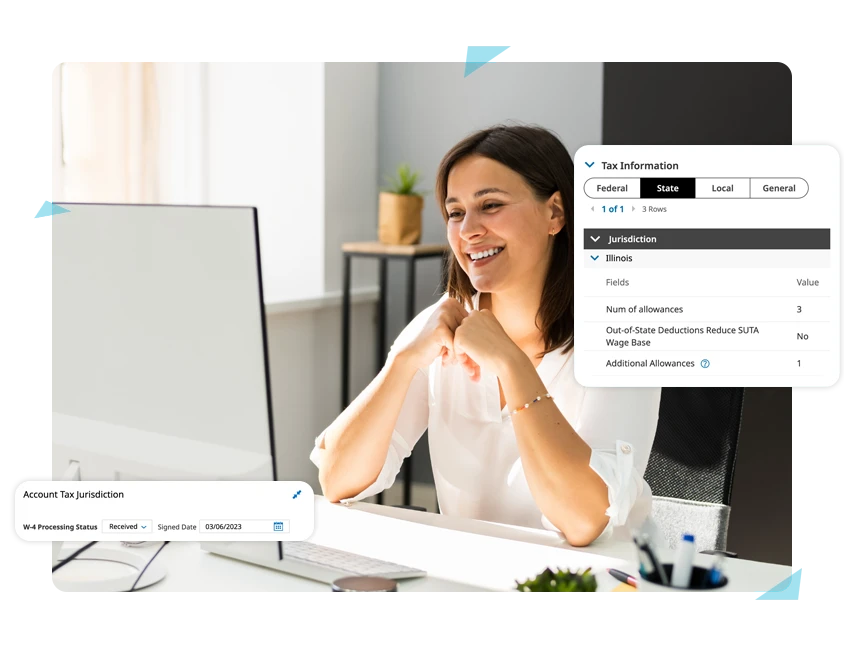

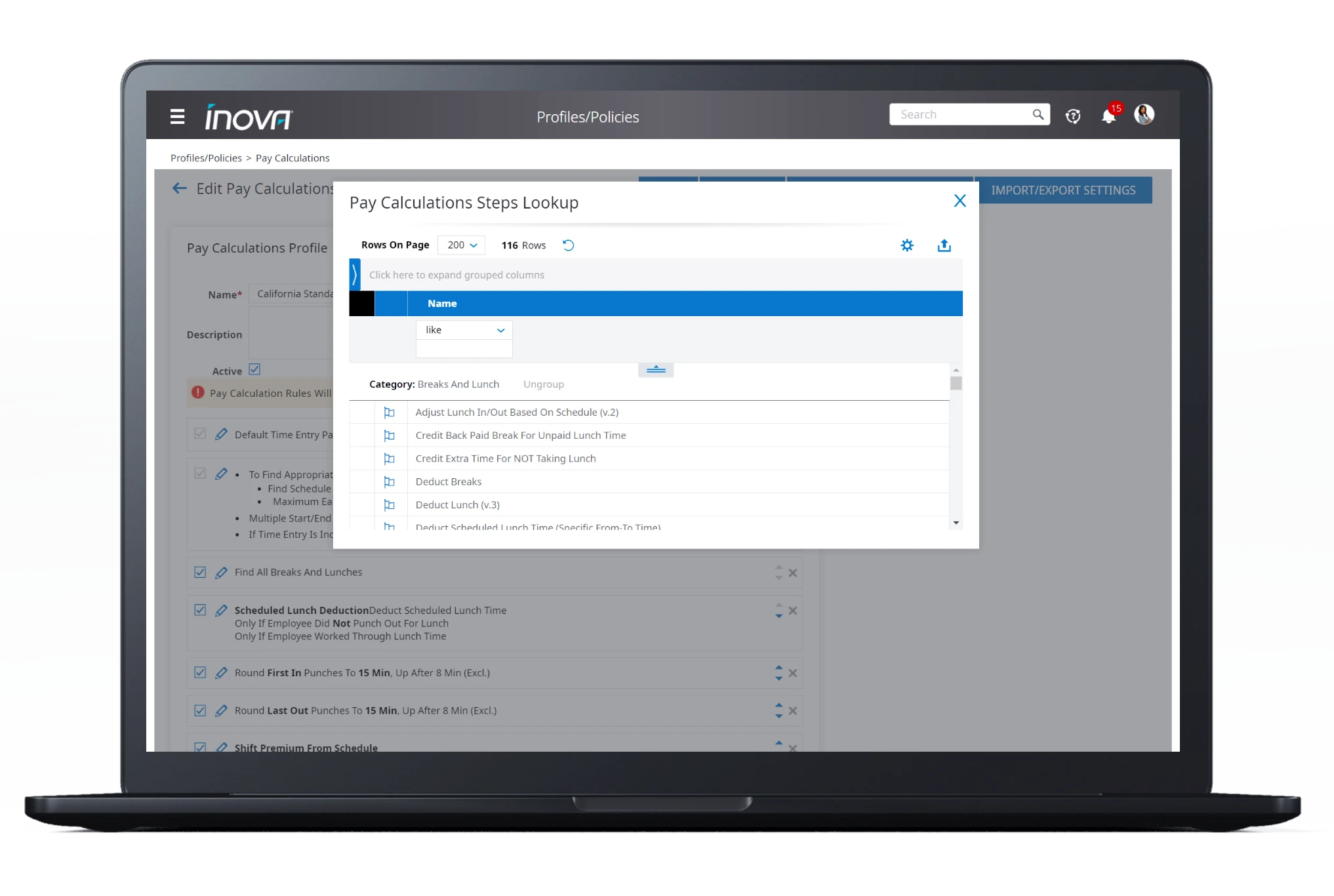

Increase Accuracy, Save Time, and Minimize Risk

Efficient Payroll Processing for Nevada’s Dynamic Market

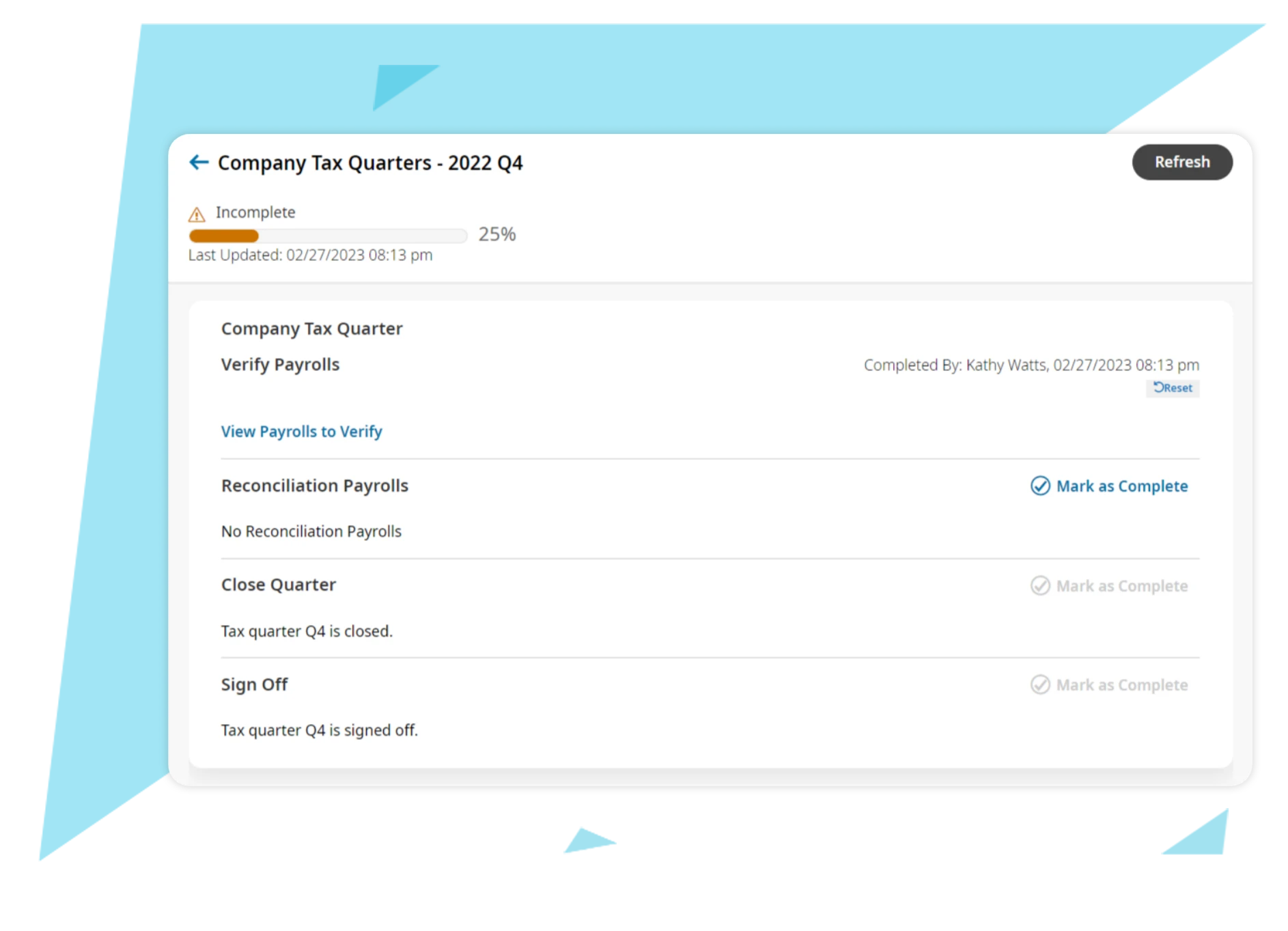

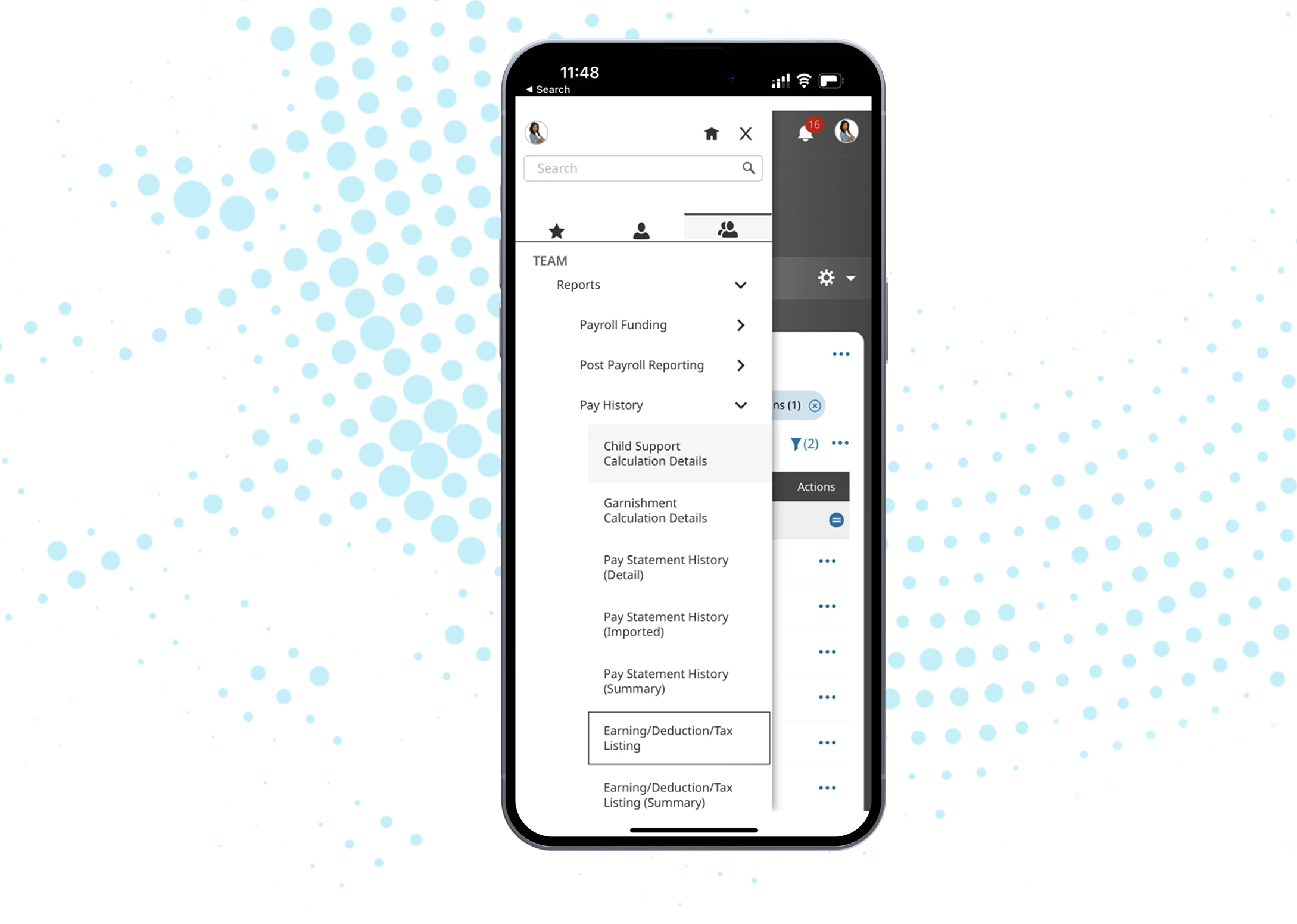

Stay on Top of the Latest Regulations and Requirements

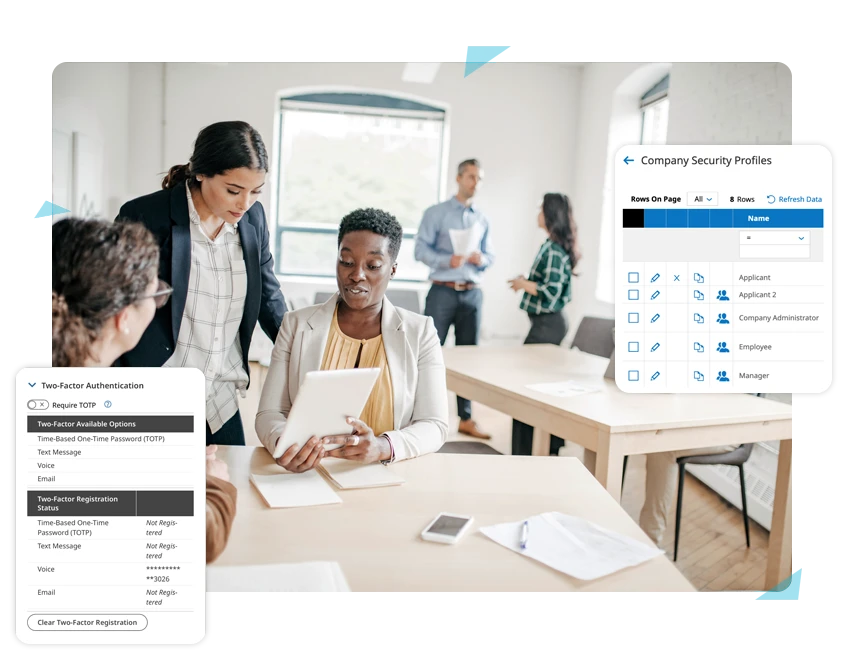

Built-In for Nevada Businesses

Work with People Who Know What They’re Doing

Trustworthy Tax Filing for Nevada Businesses