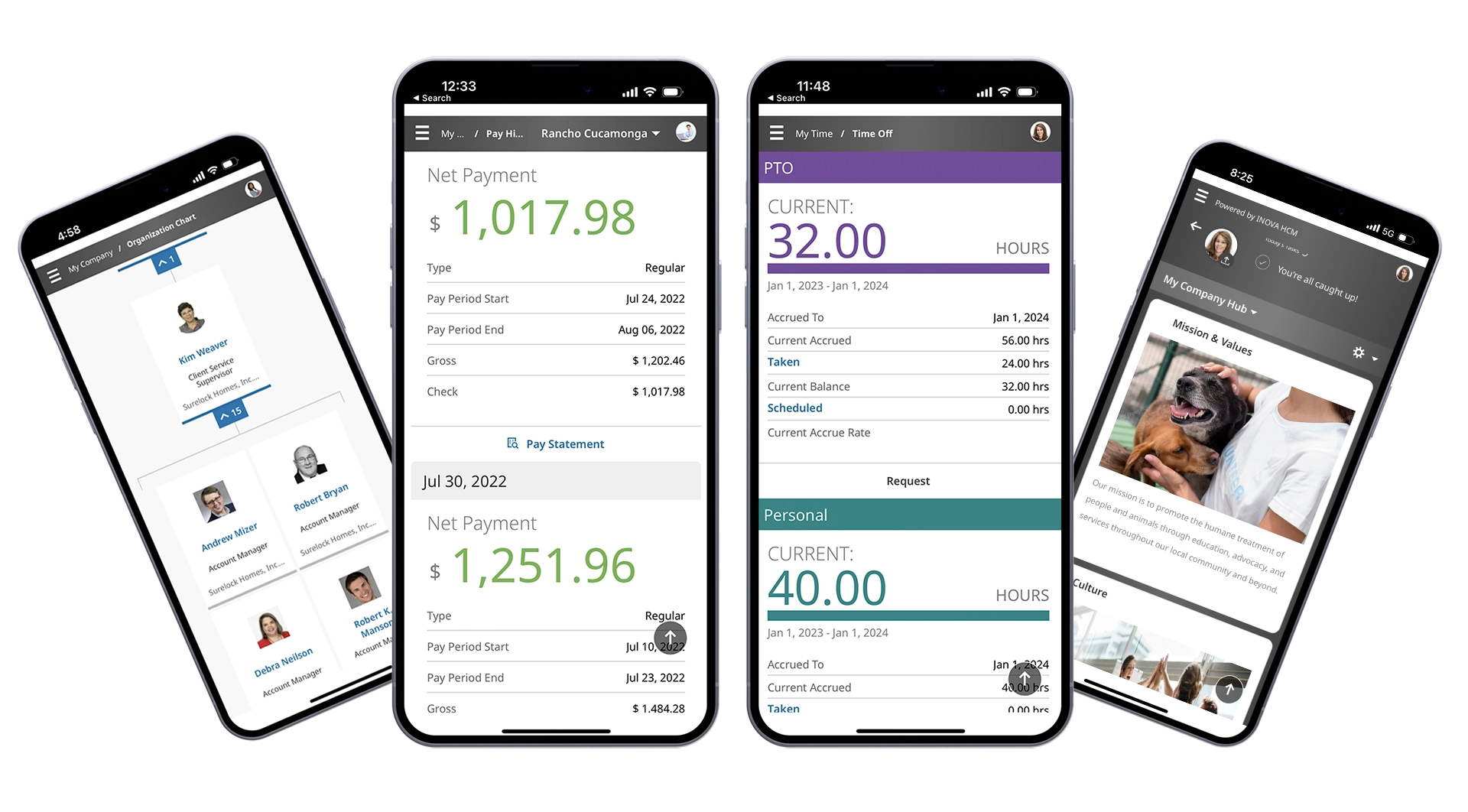

Your single solution for all things

HR, Payroll, Benefits and More

One complete HR ecosystem to manage everything. We thoughtfully designed our platform to be intuitive and save you time and money.

Software Advice

4.7 Star Rating

G2

4.3 Star Rating

Capterra

4.7 Star Rating

Technology Evaluation

4.7 Star Rating

The best choice for HR Solutions

Why Clients Choose Inova

Don’t Just Take Our Word

What Our Clients Are Saying

Who we serve

Our Key Industries

Supporting over 5,500 businesses and 250,000+ employees across the U.S. with 11 offices in all time zones working in: