The IRS recently announced new Health Savings Account

In addition to this blog post, be sure to

In a close 3-2 decision on Tuesday, April

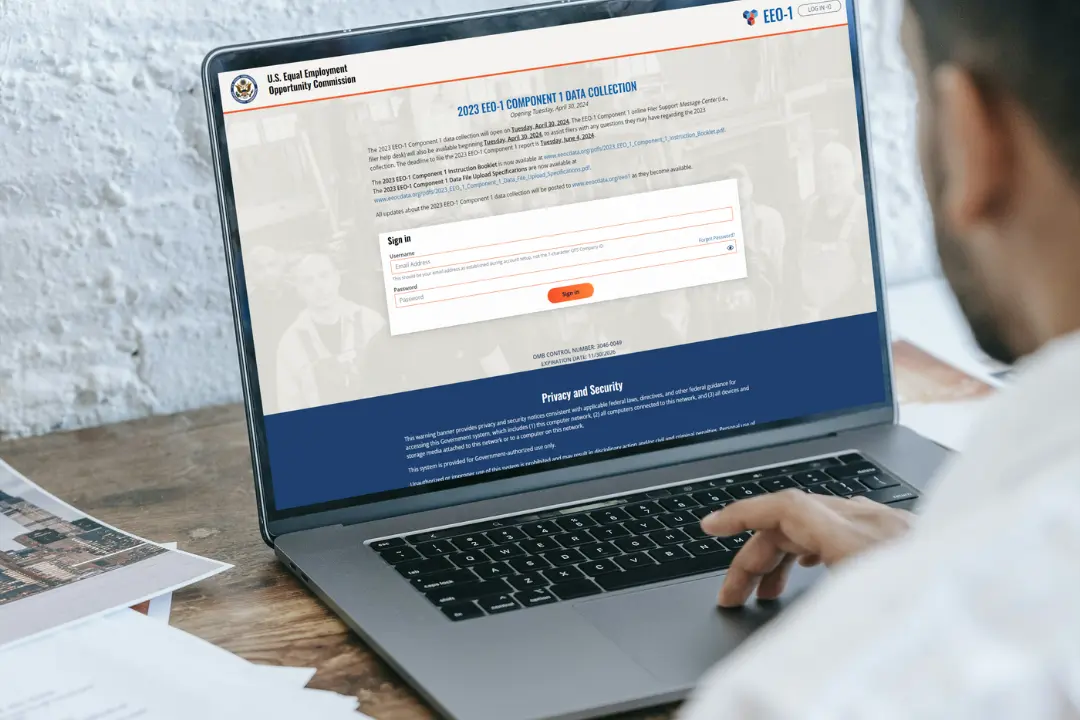

The U.S. Equal Employment Opportunity Commission (EEOC) has

The U.S. Equal Employment Opportunity Commission (EEOC) is

As we navigate the ever-evolving landscape of work in

Since its 1938 debut, the Fair Labor Standards

As we transition into a new tax year,

It can be tough to keep up with

California employers should be aware of several new

The Federal Unemployment Tax Act (FUTA) plays a

As the festive season approaches, so does the